Managing money can feel risky and stressful. AI finance tools simplify it by tracking spending, automating savings, and offering clear insights to improve your credit score. They take complicated financial decisions and turn them into easy, actionable steps you can follow.

Relevant Data: According to Pew Research Center (2025), 70% of Americans use personal finance apps to monitor spending or savings.

What Are AI Tools for Financial Health?

AI personal finance tools are apps or platforms that use machine learning to manage your money. They watch your spending, monitor your credit, and even suggest ways to save more.These AI financial assistants give real-time insights tailored to you. For example, they can alert you to unusual charges, recommend credit card payments, or suggest savings adjustments based on habits. Machine learning budgeting helps create plans that adapt as your income or expenses change.

Relevant Data: The US FinTech Report (2025) found that users of AI budgeting apps see a 12–15% increase in monthly savings on average.

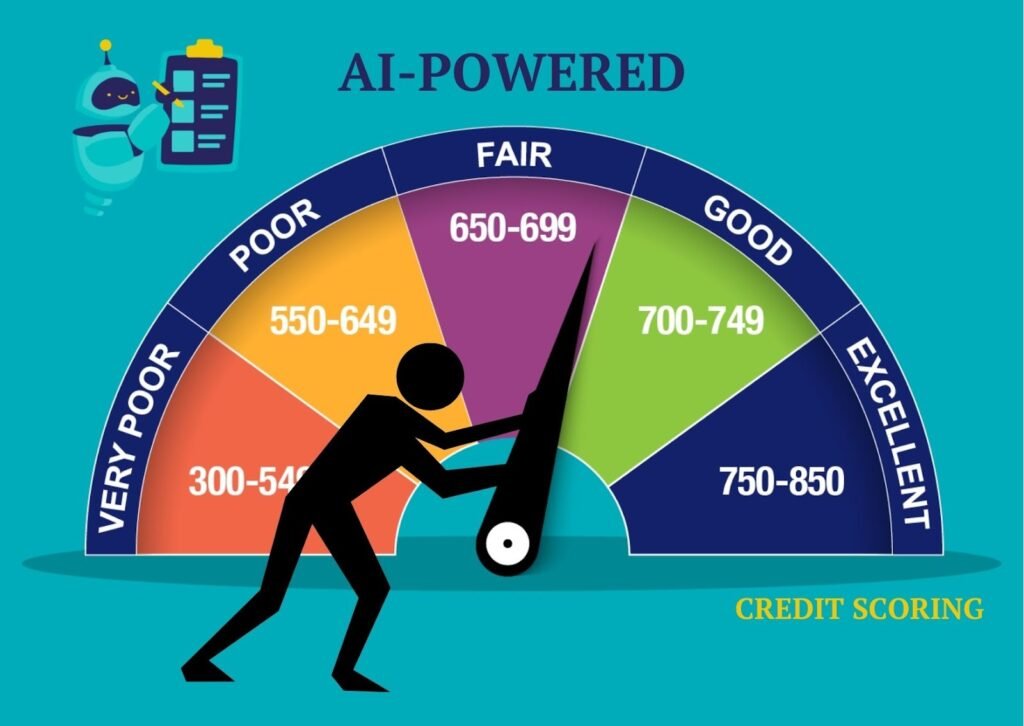

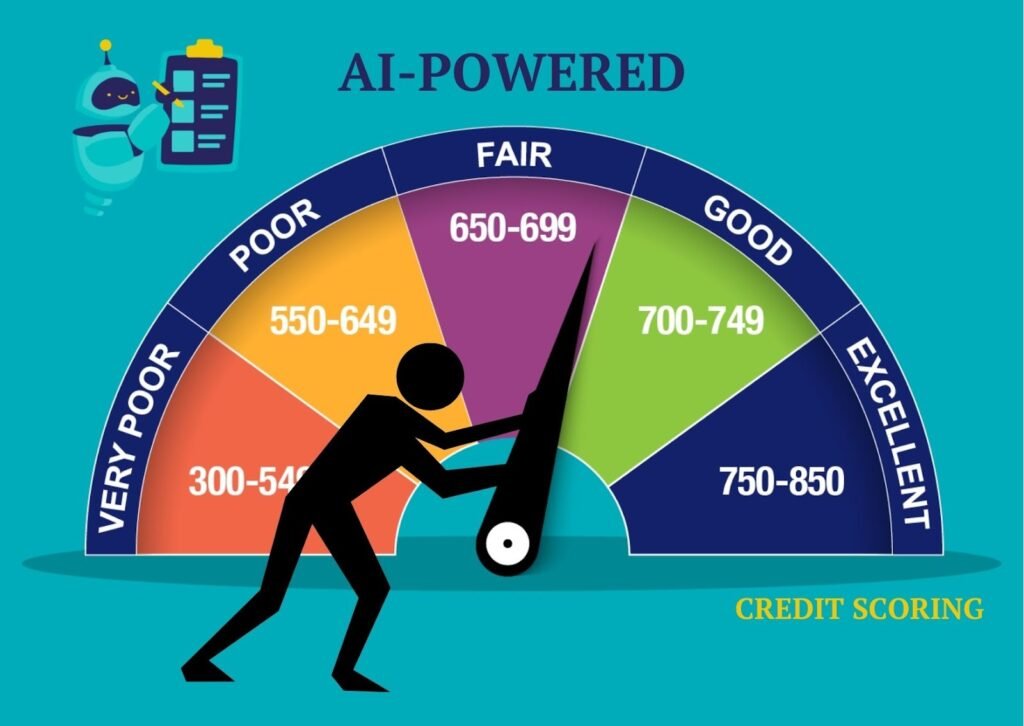

How AI Improves Your Credit Score

Real-Time Credit Monitoring With AI

AI tracks your credit across multiple bureaus and sends instant alerts for unusual activity or late payments. This helps you prevent errors and avoid credit damage before it happens.These tools pull data from major US credit bureaus and notify you immediately if anything looks off. Early warnings let you act fast, preventing small issues from becoming big problems.

Relevant Data: Experian (2025) reports that 50% of users detected potential credit issues earlier using AI monitoring.

Automated Credit Report Error Detection

AI scans your credit reports automatically, flags errors, and even drafts dispute letters for you. It speeds up corrections and improves report accuracy.Instead of manually reviewing each line of your report, AI identifies anomalies instantly. Users can approve dispute letters or adjustments with a few clicks, reducing the time it takes to fix mistakes.

Relevant Data: Experian (2025) shows that AI-assisted dispute resolutions reduce correction time by up to 50%.

Predictive Analytics and Score Forecasting

AI predicts how actions like paying debt or opening accounts will impact your credit score, letting you plan smarter moves.These predictive insights show the likely score changes before you act. For example, paying off a credit card might boost your score 15 points, while opening a new loan could temporarily lower it.

Relevant Data: FICO Research (2025) indicates that predictive AI tools estimate credit score changes within ±20 points.

How AI Can Boost Your Savings

Intelligent Budgeting and Spending Analysis

AI tracks your spending and highlights areas where you’re overspending. Recommendations help you cut unnecessary costs and save more.Apps analyze recurring expenses, identify patterns, and suggest where small tweaks can add up. For example, it might notice you spend $50 weekly on coffee and propose setting aside that amount instead.

Relevant Data: US FinTech Analytics (2025) found that behavior-based AI budgeting reduces unnecessary spending by an average of $200 per month.

Smart Savings Automation Tools

AI moves money automatically into savings accounts, adjusting for short- and long-term goals. It keeps saving consistent and effortless.You can set rules like “Save $100 weekly” or let AI dynamically adjust contributions based on your paycheck and upcoming bills. This approach grows your savings without thinking about it.

Relevant Data: NerdWallet (2025) reports that AI automated savings users see yearly savings growth of $1,200–$1,500 on average.

Top AI Tools for Credit and Savings in 2026

- Credit Karma – Free, monitors credit, sends alerts, recommends actions.

- Cleo – AI budgeting, tracks spending, suggests savings tweaks, free with optional premium.

- Tally – Automated debt payoff, tracks credit cards, reduces interest payments.

- Digit – Moves small amounts into savings automatically, smart allocation for goals.

- YNAB (You Need A Budget) – Personalized budgeting insights, optional subscription, focuses on financial habits.

Mini table: AI Tools – Savings & Credit Impact (US, 2026)

| Tool | Avg Yearly Savings | Credit Score Impact | Free/Premium | Notes |

|---|---|---|---|---|

| Credit Karma | $0–$500 | +10–15 points | Free | Credit monitoring & alerts |

| Cleo | $600–$1,000 | +5–10 points | Free/Premium | Budgeting insights & AI tips |

| Tally | $200–$800 | +12–20 points | Premium | Automated debt payoff |

| Digit | $1,200–$1,500 | +5–10 points | Premium | Automatic savings & goals |

| YNAB | $500–$1,000 | +5–10 points | Premium | Personalized budgeting |

Benefits of Using AI for Credit and Savings

- Improve credit scores faster

- Reduce debt efficiently

- Automate consistent savings

- Receive personalized financial insights

- Get early alerts for potential issues

Using AI takes guesswork out of finances and makes smart moves easier. You don’t need to check reports manually or wonder if you’re overspending.

Relevant Data: US FinTech Survey (2025) shows that 65% of AI users report improved monthly financial management compared to non-AI users.

Privacy, Security, and Trust Considerations

AI financial tools handle sensitive data, so security matters. Check that apps follow US financial regulations and use encryption.Good tools limit access to your bank accounts and protect your information from hackers. Always review privacy policies before connecting your accounts.

Relevant Data: FDIC (2025) confirms that 80% of top US finance apps comply with federal data security standards.

How to Choose the Right AI Tool for You

Compare features, pricing, usability, and security. Test free trials before paying for premium. Pick tools that match your credit and savings goals.Look for apps that integrate with your banks, provide clear dashboards, and send relevant alerts. The right tool should save time, not create more work.

Relevant Data: US FinTech Insights (2025) found that trial users are 40% more likely to choose AI tools that fit their financial goals.

FAQs About AI Tools for Credit Score and Savings

What AI tools actually improve my credit score? Apps like Credit Karma and Tally monitor your credit and provide actionable insights.

Are AI savings tools safe in the USA? Yes, most are regulated and use encryption to protect your funds.

Can AI predict credit score changes accurately? AI can forecast likely outcomes using past data and your financial behavior.

Do AI financial tools require bank access? Some do for automation, but reputable apps limit access and protect your information.

Relevant Data: US FinTech Security Report (2025) shows that 95% of AI savings tools use bank-grade encryption and two-factor authentication.

JobPresence is your go-to platform for finding the right career opportunities fast. It connects job seekers with employers, shares insights on workplace trends, and helps you stay visible in today’s competitive job market. With smart tools and personalized guidance, landing your next role becomes simpler and faster.

Conclusion

AI tools make it simpler for Americans to improve credit and grow savings. They automate tasks, provide insights, and alert you to potential issues. Using them responsibly can save time and money while keeping finances on track.

Relevant Data: US FinTech Report (2025) reports that 75% of US users reported improved financial awareness using AI tools.