How to Start a Career in Investment Banking

Starting a career in investment banking involves understanding the role, which includes helping companies raise capital and advising on financial strategies.

Key investment banking skills

Critical investment banking skills such as financial modelling and analytical thinking are essential. Gaining experience through banking internships provides valuable industry insights and networking opportunities. A degree in finance or economics is typically required for investment banker qualifications, and pursuing an MBA can enhance prospects. Begin with entry-level finance jobs to build experience, leading to a corporate finance career.

Focus on career progression in finance to reach senior roles. Explore various career opportunities in investment banking to find your niche and grow in the field, ensuring you stay informed and adaptable.

Internships in Investment Banking

Investment banking internships are a great way to gain experience and learn about the industry. They help you build essential skills like financial analysis and teamwork. These internships often lead to entry-level finance jobs and let you meet people who can help your career.

They also clarify your career goals and boost your chances of success in a corporate finance career. By gaining hands-on experience, you improve your investment banker qualifications and open up more career opportunities in investment banking.

Which is Better for Investment Banking?

When comparing the CPA (Certified Public Accountant) and CFA (Chartered Financial Analyst) designations for a career in investment banking, it’s essential to consider which credential best aligns with your goals and the industry’s demands. Understanding the nuances between these designations is crucial for making an informed decision.

CPA (Certified Public Accountant)

- Expertise: The CPA designation is well-respected in the accounting and finance industries. It emphasizes rigorous training in accounting principles, auditing, taxation, and financial reporting. CPAs are recognized for their deep understanding of financial statements, regulatory compliance, and tax strategies.

- Authority: CPAs are licensed professionals, often required by law to certify financial documents and ensure adherence to regulatory standards. Their jurisdiction in auditing and financial reporting is critical, particularly in areas like mergers and acquisitions (M&A), where precise valuation and due diligence are necessary.

- Trustworthiness: The CPA credential is synonymous with integrity and reliability, qualities that are vital in investment banking. CPAs are bound by a strict code of ethics, ensuring they uphold the highest financial reporting and corporate governance standards.

CFA (Chartered Financial Analyst)

- Expertise: The CFA designation is globally recognized for its focus on investment management, financial analysis, portfolio management, and securities analysis. The CFA program is known for its depth and rigour, covering equity research, fixed income, derivatives, and alternative investments.

- Authority: CFAs are considered experts in financial markets and investment strategies, making them highly sought after in roles that involve market analysis, client advisory, and asset management. Their expertise is precious in the front-office functions of investment banking, where they provide insights into market trends and investment opportunities.

- Trustworthiness: The CFA designation is associated with a solid commitment to ethical practices in investment management. CFAs adhere to a code of ethics and standards of professional conduct that emphasize integrity, transparency, and client interests, which are essential in the high-stakes environment of investment banking.

How Much Money Does an Investment Banker Make?

Investment bankers usually earn a lot of money, but it can vary. When starting, they might make between $100,000 and $150,000 a year, including bonuses. As they get more experienced, they can earn between $150,000 and $300,000. In senior roles, they might make from $300,000 to several million dollars a year. A big part of their pay comes from bonuses, which depend on how well they and their company perform.

Types of Investment Banking

Investment banking helps businesses with important financial tasks like raising money, buying or merging with other companies, and managing large transactions. There are different types of investment banks, each serving different needs. Here’s a look at the main types:

1. Bulge Bracket Investment Banks

Bulge bracket banks are the most prominent players in the investment world. They handle huge deals, often worth billions. These banks offer various services, including underwriting, mergers and acquisitions (M&A), and managing investments. They work with large corporations, governments, and big investors.

Examples: Goldman Sachs, JPMorgan Chase, Morgan Stanley.

2. Middle Market Investment Banks

Middle-market banks focus on medium-sized companies. They handle deals that are smaller than those managed by bulge bracket banks. These banks provide services like M&A advisory and helping companies raise money. They often work in regional or smaller markets.

Examples: Houlihan Lokey, Baird, Raymond James.

3. Elite Boutique Investment Banks

Elite boutique banks are smaller and more specialized. They focus on high-value deals and advise on things like M&A and restructuring. Even though they are smaller, they often handle complex and essential transactions.

Examples: Evercore, Lazard, Centerview Partners.

4. Regional Boutique Investment Banks

Regional boutique banks are small banks that focus on specific regions or industries. They provide personal service to small and mid-sized businesses and are great for companies looking for local expertise.

Examples: Piper Sandler, Stephens Inc.

5. Industry-Focused Investment Banks

Some investment banks specialize in certain industries, such as technology, healthcare, or energy. These industry-focused banks understand the unique needs of their chosen sectors and offer tailored services.

Examples: Cowen (biotech and healthcare), Allen & Company (media and technology).

6. In-House Investment Banking

In-house investment banking teams are part of large companies. These teams manage the company’s financial strategies, like buying other businesses or raising capital, without relying on outside banks.

7. M&A Advisory Firms

M&A advisory firms are experts in mergers and acquisitions. They help companies with deal-making, including structuring and negotiating. These firms are perfect for businesses looking to buy, sell, or merge with others.

Examples: Harris Williams, William Blair.

8. Restructuring Firms

Restructuring firms specialize in helping companies in financial trouble. They advise on reorganizing or avoiding bankruptcy and work with all involved parties to save the business.

Examples: AlixPartners, FTI Consulting.

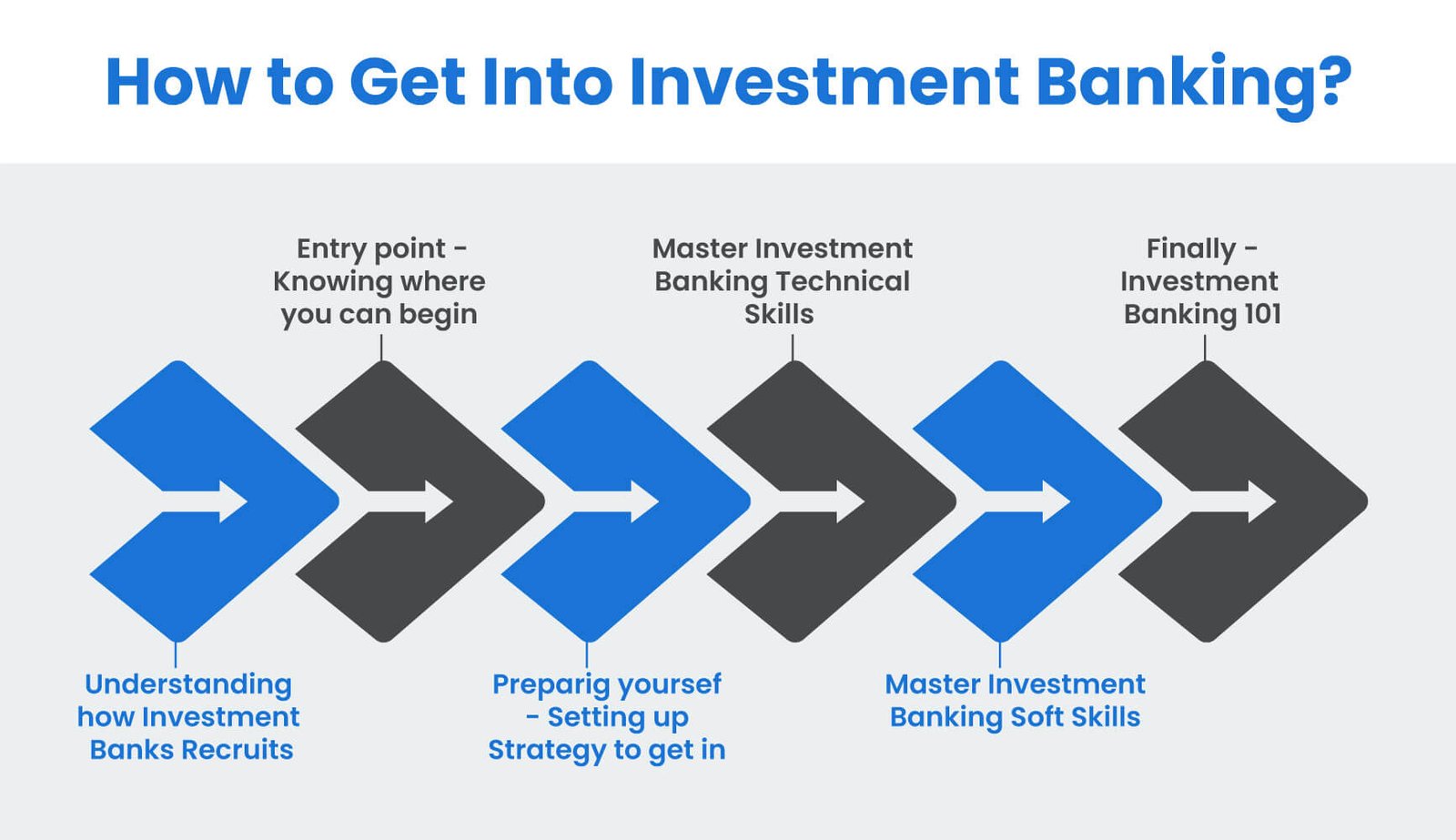

How to become an investment banker

Becoming an investment banker is a step-by-step process that involves education, gaining experience, and building the right skills. Here’s a simple guide on how to get started:

Get a College Degree

- Study the Right Subjects: Start by earning a bachelor’s degree in finance, economics, business, or something similar. Focus on math, accounting, and economics to build a strong foundation.

2. Think About Further Education

- Master’s Degree or MBA: Some people get a master’s degree or an MBA (Master of Business Administration) to learn more about finance and increase their chances of landing a good job. That isn’t only sometimes necessary, but it can also be helpful.

Read more….

Top 5 skills for investment bankers

3. Gain Experience

- Internships: While in school, try to get internships at investment banks. Internships are important because they give real-world experience and can lead to a full-time job later.

- Start with an Entry-Level Job: After graduation, look for entry-level positions like an analyst role. As an analyst, you’ll learn investment banking basics by working on financial reports, researching companies, and helping with deals.

4. Build Key Skills

- Financial Skills: Learn to work with numbers, create financial models, and analyze data. That is a big part of the job.

- Communication: Be able to explain financial information clearly to others. Good communication skills are essential.

- Attention to Detail: Small mistakes can have significant consequences, so being careful and precise is necessary.

5. Network

- Connect with Others: Networking is about meeting people who work in the field. Attend events, join finance-related groups, and reach out to professionals online.

- Use Alumni Connections: If your college has a network of former students (alums) working in investment banking, contact them for advice and job leads.

6. Get Certified (Optional)

- Consider Certifications: Some people get certifications like the CFA (Chartered Financial Analyst) to boost their qualifications. These can be helpful, especially in roles focused on analyzing investments.

7. Apply for Jobs

- Target Investment Banks: Apply for jobs at well-known investment banks and smaller firms. Make sure your resume highlights your education, internships, and skills.

- Prepare for Interviews: Practice answering questions about finance and how you work with others. Mock interviews can help you get ready.

8. Advance Your Career

- Climb the Ladder: Start as an analyst and work to higher positions like associate, vice president, and beyond. With experience, you’ll take on more responsibilities and lead projects.

9. Keep Learning

- Stay Informed: The finance world changes quickly, so keep up with the latest news and trends. That will help you stay ahead in your career.

Conclusion

Starting a career in investment banking involves understanding the industry, developing critical skills like financial modelling, and gaining experience through internships. A degree in finance or economics is usually required, and an MBA can boost your prospects. Begin with entry-level jobs to build knowledge and advance in the field.

Internships are crucial for learning and networking. Whether you pursue a CPA or CFA depends on your career goals. Each offers unique advantages.

Investment banking includes areas such as M&A, underwriting, and equity research. Staying informed and continuously improving your skills are essential for success in this competitive field.